How Accounting Supports Your Business

Accounting means different things to different people, but it is certainly not a one-dimensional department.

There is the operational and administrative, day-to-day bookkeeping for the business, which involves accepting deposits from guests, transacting management fees, and paying out to owners, as well as everything in-between. This is what most managers picture first when they think of accounting, but there is a second part that is equally important.

The second part of accounting addresses the long-term view of what all those transactions add up to, reflecting how the investment and strategy are performing in the bigger picture. This includes aspects of accounting that produce information for budgeting and planning.

Accounting Skills to Seek Out

It can be easy during the first few years of a startup for bad habits and patchwork processes to start seeping into your accounting department, especially if it’s being done by only one person.

One of the key internal control procedures for accounting is the separation of duties. This means that no one person should handle a transaction from beginning to end, for example, bookkeeping, deposits, reporting, and auditing.

Sharing responsibilities between two or more people or having co-workers review critical tasks can help provide some controls against errors or fraud. But you still need to have someone with the right experience and skills to know how to manage the accounting for vacation rentals in the first place.

Certification

Each state has different requirements for accountants to become certified to work, but there are also continuing professional education hours that may be recommended or required.

The most common certification is the Certified Public Accountant (CPA), granted by the American Institute of Certified Public Accountants (AICPA). This license is a versatile designation for accounting professionals pursuing a variety of roles.

There are many other certifications that can also indicate an accountant’s level of expertise in a certain field.

Industry Experience

Trust accounting for short-term rentals is a time- and labor-intensive activity that occurs on a monthly basis. When that is coupled with the unique operational aspects of vacation rental management, it is a special area of expertise that not many accountants have.

Someone who understands the industry of short-term rentals specifically will be able to help you make strategic choices and provide insights based on relevant experience.

Accounting Experience

The fast-moving nature of the vacation rental industry requires extremely detailed accounting.

For hosts with multiple ventures on the horizon, you may have multiple business models that all need accounting support as well. Therefore, you will want a professional on your team who can perform a range of functions to support your near-term and long-term interests.

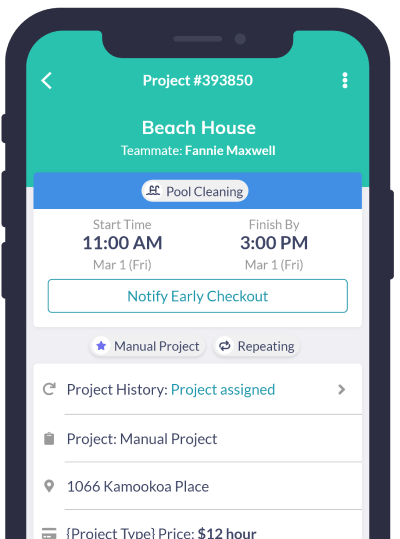

Technology Enablement

Whether you choose to keep your accounting services in-house or select a partner to outsource, the person who is at the helm of your accounting should be an expert in the software that your business needs today. Not only that, but they must also be able to implement new technologies as the needs of the business change.

This requires them to stay involved in both strategic and operational aspects of the business and be able to scout the market for current technologies.

If you choose to hire outside accounting help, make sure you ask what systems they are certified to work on and what types of integrations they can support.

This will tell you if they have capabilities that go beyond what you could accomplish in-house.

Types of Accounting Support You Can Choose for Your Business

For vacation rental startups, starting with a good foundation of support in your accounting processes is crucial.

Bookkeeper

Running a one-person show can really only work for so long. Some hosts are better to start off with an employee who maintains the company’s books (sometimes called a bookkeeper). This is the person assigned to oversee all the financial transactions administered by the business and help you draw insights from financial statements.

Accounting Consultant

What about going outside the organization? Your accountant doesn’t necessarily need to be an employee. After all, there are professional accounting consultants that you can hire on a temporary or retainer basis if you want to go that route instead.

This may be a good way for new hosts with little accounting experience to get started without being responsible for the expense of a salaried, permanent staff member.

Accounting Firm

This arrangement might work for a few years, but remember, bad habits grow quietly. Without proper oversight and careful workflows, small errors in accounting records or late filings can have serious consequences for property managers and owners. As your operational workload increases, so does the risk for human errors.

If you are concerned about absolute accuracy and compliance, you may want to consider an accounting firm to completely outsource these functions. With outsourcing, you don’t have to gamble on whether or not someone will have the right combination of skills. Nor will you have to make tradeoffs for what is most important to you.

Selecting a firm can be easier than hiring an individual because you can set higher expectations. Refer back to those accounting skills we mentioned, and quiz your prospective firms before making a decision.

Moreover, choosing an outsourced accounting firm isn’t like working with other vendors — it’s a partnership. Successful outsourcing requires a good working relationship and trust between the firm and the client. You should never settle for services that don’t satisfy 100% of your needs. If they don’t have the complete package, keep looking.

Vacation Rental Accounting Support Through Software

As an entrepreneur, you will likely start off wearing many different hats for your vacation rental business. If you’ve studied accounting, or have your CPA certification, you definitely have an advantage. But as we’ve demonstrated, trust accounting is not a hands-off process.

One way to start lean and still run efficiently is to choose the right software and automate every manual process that you can.

This is where resources like VRPlatform come into play. These tools receive PMS data, such as management commissions, guest invoices, and payments, and automatically record the proper entries in the accounting system. They eliminate the manual process of re-keying data into your accounting system to make tasks more efficient.

Design Your Accounting Roadmap

Using the information discussed here, you can start planning out how accounting roles will be assigned for your business and how that structure might change over time.

Remember, good accounting and bookkeeping processes are not a box to check. Your success as a vacation rental host depends on your ability to make the right decisions for your business, and you can’t do that without accurate and organized finances.