What Is a Business License and Do I Need One?

To operate as a legal vacation rental cleaning business in the United States, you will need a business license. Acquiring one allows your business to function legally in your state and will help you protect your business from any claims of illegality or unsafe practices.

Business licenses are essential because they make sure that you are following the laws that apply to your company and allow you to correctly pay your taxes.

As a cleaner, you frequently handle cleaning agents and various types of equipment. Your clients will want to know that you will be held accountable for any mishandling of supplies. For example, if you misuse a power washer and damage a client’s fence, you’ll be protected from damage costs with a business license that allows you to operate with a power washer.

In addition, your cleaning business license will help you understand your finances and taxes. Your cleaning business license will aid the government in knowing just how much money you’ve brought in and how much in taxes to take out. The last thing you want as a cleaning business is to misfile your finances and taxes with the government.

Benefits of Licensing Your Cleaning Business

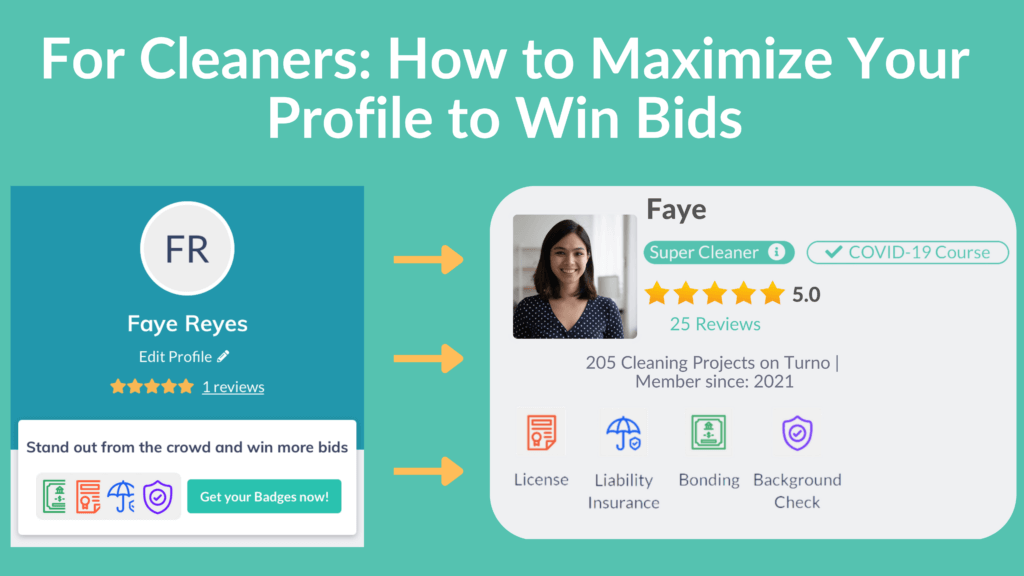

When you license your cleaning business, you put your business at the forefront of the industry. Cleaning is relatively personal as the service takes place usually in someone’s home or rental property. Being licensed, bonded, and insured gives clients the assurance that their property will be covered by a third-party company.

Cost Breakdown of a Cleaning Business License

Generally, a business license will cost about $50. However, this cost varies in all 50 states.

There may also be renewal fees and other expenses associated with registering a business depending on your city or state. In some cases, depending on the licensing you choose for your vacation rental cleaning business, the cost varies by county.

How to Obtain a Cleaning Business License

Business licenses are issued when you register your business entity with the state or county. A vacation rental cleaner might register with the county clerk as a sole proprietor, “doing business as” (DBA) the company name. The DBA gives you the authority to advertise and operate as the business name but follows your personal tax identification number for all tax purposes.

1. Contact Your Local Department of Revenue or Taxation

To get a cleaning service license, start by contacting your city’s Department of Revenue or Department of Taxation. You may be redirected to your county clerk or city licensing board depending on where you live.

2. Understand Your Local Cleaning Business License Rules

States have a lot of different rules about whether business licenses are issued by the state, counties, and towns — or towns only. If you also need a state license, the city or county clerk’s office will provide guidance on your next steps. In many areas, you will need both county and city or town licenses.

In almost every location across the country, you will need to obtain a business license before starting your cleaning company. Also, if you hire any alien workers for your cleaning business, you will need a business license so that you can fill out the required I-9 forms.

Your local representative will explain what’s required to get your cleaning or janitorial license. You might need to open a business bank account or purchase a surety bond first. They’ll also give you some paperwork and go over the fees.

What You Need to Apply for Licensing

Before you can apply for a business license, you will want to double-check that you have all paperwork and requirements handled.

You’ll need to provide the following information to apply for a business license:

- Type of business

- Business address

- Name of business owner

- Contact information

- Federal ID number

- Number of employees

Many city clerks will ask for your employer identification number (EIN). This is like a social security number for your business and will come in handy for everything from opening a business account to filing taxes. An EIN is free to obtain, and you will need it to license your business.

You may have to acquire permits and certifications to qualify for a business license depending on where you live. You may also be asked basic questions about the type of business activity you engage in as well as how much you make (or hope to make) in revenue.

Be prepared and have all of your documents ready before applying for the license. Having any required documentation at the ready will ensure you spend minimal time at the business license department of your local government and don’t risk being charged additional fees for not having everything needed to apply.

Types of Licenses for Small Cleaning Businesses

It’s always better to be safe than sorry when licensing your cleaning business. Outside of your standing cleaning business license, you may want to look into what other business licenses apply to you and your services.

Vendor’s License

A vendor’s license is usually the same as a basic business license. It allows you to collect sales tax on the cleaning supplies you purchase, which some states require. If you charge clients for cleaning products separately from the service, you are likely required to collect sales tax.

Most vendors’ licenses need to be renewed annually or every few years.

DBA License

A DBA license is required if your business is called anything other than your legal name. Most states require DBA licenses to protect consumers from unethical business practices. It also prohibits other companies from using your business name.

DBA licenses are valid for five years in every state. With either license, most states charge a renewal fee to keep your cleaning business license valid.

Licensing Rules by State

Starting a cleaning business will require you to look into licenses and permits in your area. In the map below, states are broken down into the following categories: State, County, and Town Licensing.

State License Required

Alaska, Delaware, Hawaii, Maryland, Nebraska, Nevada, New Hampshire, Oregon, Utah, Washington, and West Virginia

County License Required

Alabama, Arizona, Arkansas, California, Colorado, Connecticut, Florida, Georgia, Idaho, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Michigan, Mississippi, Montana, New Jersey, New Mexico, New York, North Carolina, North Dakota, Ohio, Oklahoma, Oregon, Pennsylvania, South Carolina, South Dakota, Tennessee, Texas, Vermont, Virginia, Wisconsin, and Wyoming

Only City and Town License Required

District of Columbia, Maine, Massachusetts, Minnesota, Missouri, and Rhode Island

Nav’s Business Licensing page gives more information on licensing requirements state by state. It also lists a chart ranking each state’s licensing websites by helpfulness.

Optimize Your Cleaning Business Through a Business License

Ensuring your company is properly licensed helps to bring protection to yourself, your employees, and your customers. Having the correct license will ensure your personal assets are protected in case of a lawsuit, as well. Make sure you have all your licenses and permits in order before taking on clients.